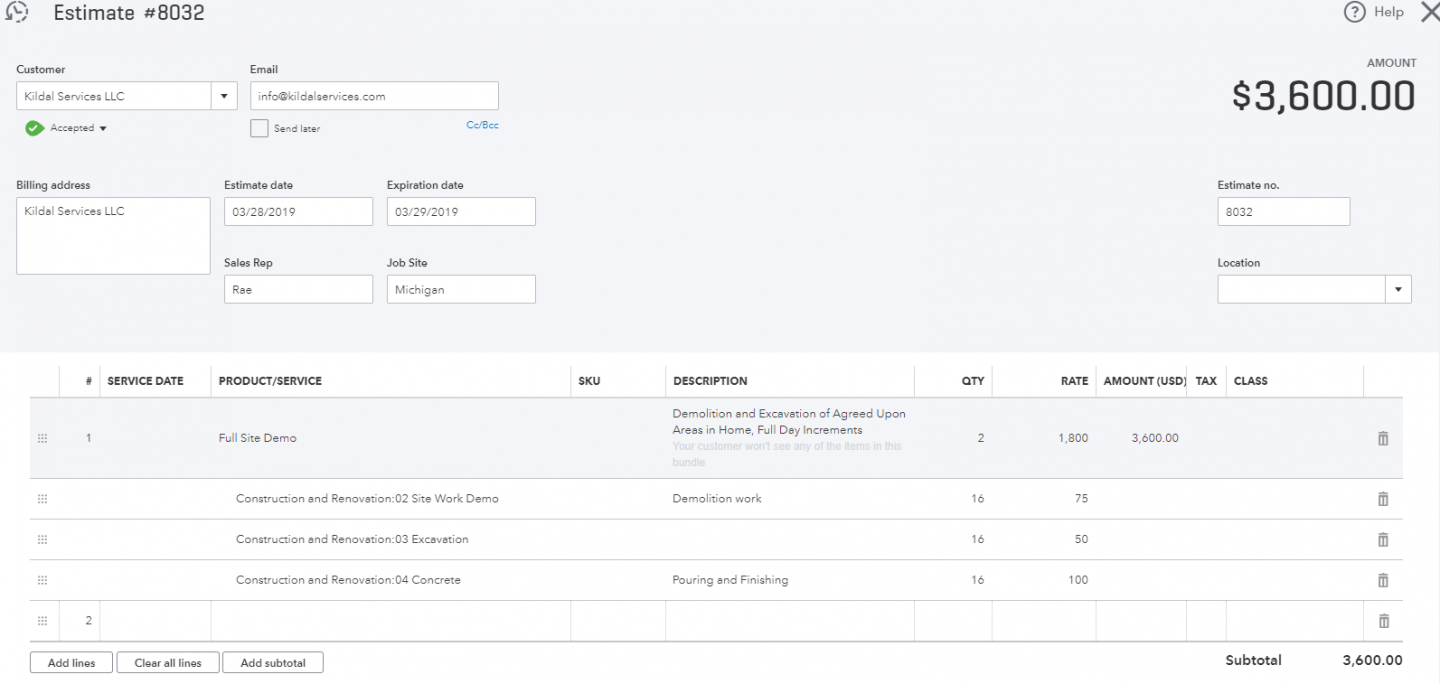

The estimate must be entered into QuickBooks. Simple, best for small projects, or where little transparency is required.

The GC must disclose their percentage markup for Overhead and Profit and detail all costs incurred. This is more frequently seen in commercial construction where price is extremely competitive, and clients are budget-driven. Guaranteed Maximum Price (also known as Cost Plus with Guaranteed Max) Cons: If a client expands the scope of the project during design or construction, you will want to re-negotiate this fee. Pros: you can’t lose money on the job if your fixed fee is calculated appropriately. This is most common in a design-build company where the fixed fee also covers design services. In this case you set a fixed amount for Overhead and Profit and then only charge labor, materials, and subcontractors at cost. T&M contracts are best for complex renovations where the scope is unclear due to hidden existing conditions or lack of plans. However, it has the most risk to the client, since the project can potentially exceed their budget without warning. It reduces risk for the GC because you are basically guaranteed that you will cover your costs – you shouldn’t lose money on a T&M job. This is a very common contract type for small jobs and renovations, although occasionally is used on larger projects. There are three variations of Cost Plus: Time and Materialsīasically cost plus a percentage markup. Cost plus can also be helpful in situations where the client is planning to self-perform some of the work (but watch out for this for other reasons!). Cost PlusĬost plus contracts require a higher degree of transparency in the estimating and invoicing, since the client will want to know exactly what they’re being charged for. However, on the flip side, there is potential for increased profitability if the GC comes in under their original estimate. They also involve more risk – if the estimate is too low, it is easy for the GC to lose money on the job. Fixed Price contracts work best when the GC is very accurate at estimating and the plans are complete. Fixed Price contracts can be difficult in complex renovation projects where the scope is not always known at the beginning of the project.

The GC sets one price, and is not required to provide detail to the client on their markups. This contract is common in much of residential construction, especially for new homes and relatively straightforward remodeling projects. Here’s a quick run-down of the four most common contract types and when they are most appropriate. renovation)Īmount of documentation needed (Will an architect require an AIA Application for Payment?)ĭegree of transparency you want to provide to the clientĪmount of risk you are willing to take as the GC Choosing a contract type can depend on a variety of factors: The most common contracts we see in residential construction are:ĭepending on what contract type you pick, you’ll have different options for how you present your invoices, and there are pros and cons to each. The first thing to understand when it comes to invoicing is the various types of contracts out there, since some invoicing methods are only appropriate for certain types of contracts. The truth is, QuickBooks does not make it that easy for construction companies, but we’ve come up with step-by-step guides to try to help clarify your options. “How do I invoice thru QuickBooks?” is one of the most common questions we get at HELM.

0 kommentar(er)

0 kommentar(er)